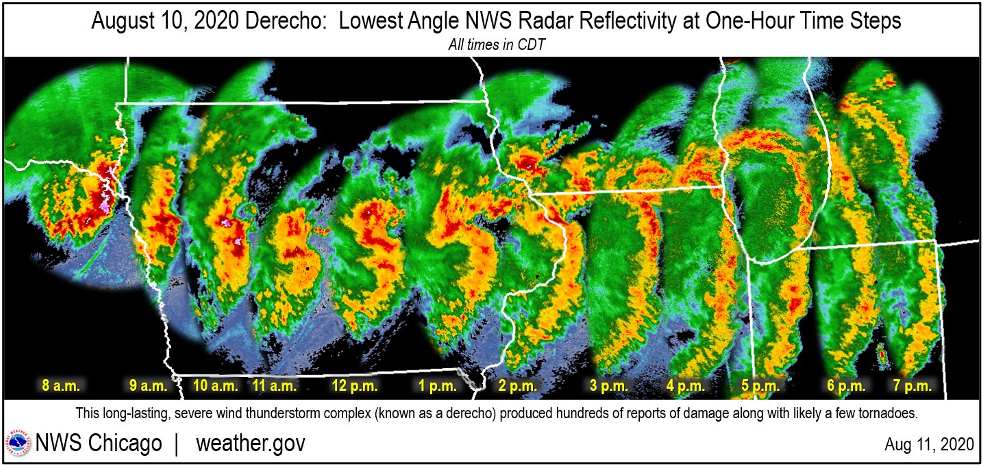

2020 was one for the record books – and we’re not just talking about the pandemic. 2020 featured some of the wildest, most unpredictable weather events in recent history. One event in particular, a derecho storm that smashed through the Midwest on August 10, 2020, caused damage in Illinois, Ohio, Minnesota, Iowa and Indiana.

According to the National Oceanographic and Atmospheric Administration (NOAA), the derecho impacted more than 37.7 million acres of Midwestern farmland – making it the second most costly natural disaster of the year.

The costliest U.S. disaster of 2020? That title goes to Hurricane Laura, which caused $14 billion in damage when it ravaged the Gulf Coast last August, according to NOAA. In fact, Laura was one of twelve named storms (yes, that’s a record) and six record-tying hurricanes to hit the United States in 2020.

While these events caused farmers a variety of headaches, risk management experts advise that it’s time to move forward and plan for a successful 2021. So what’s the first step?

“It’s absolutely critical for growers to re-evaluate their risk management plan every single year,” says Matt St. Ledger, an Area Manager with Ag Resource Management based in Haubstadt, IN. “Every year, new insurance products become available, and those need to be evaluated. Some years, new or different adjustments are allowed on your Actual Production History (APH) calculation. A farmer’s crop mix can change year over year. There’s a lot to be evaluated each year to make sure the risk management plan is going to cover the farming operation adequately.”

Before beginning the process of calculating risk management, it’s important to select the right experts to partner with, according to Billy Moore, President of Insurance at Ag Resource Management. Find a risk management partner who will customize a risk management plan specifically to your farm operation’s needs.

“We have the ability to see farm by farm, acre by acre, what the best potential for that farming operation is,” says St. Ledger. “The technology allows us to dive into deep detail on any specific farm, looking at the best potential crop mixes and risk management plan to produce the best potential profit for that operation. We know every farm has its own unique potential, and that’s what we gear our lending and risk management planning toward.”

Moore and St. Ledger laid out a step-by-step plan they follow with clients when planning for the upcoming crop year:

· Step One: Get Your APH Adjustment Correct Now

· Step Two: Analyze the Good and Bad of 2020

· Step Three: Evaluate New Offerings

“I tell every grower I sit down with that it’s my job to find where those exposures or risk gaps are,” says Moore. “We want to take out the minimum amount of insurance needed to put them into a position where they can pay their bills and go farm for another year. That’s our business – to help you keep that farming operation going year after year.”

For more information, contact your nearest Ag Resource Management area manager or visit armlend.com.