As the COVID-19 pandemic swept around the globe in 2020, it forced business and manufacturing shutdowns that disrupted industries far and wide – and agriculture was no exception.

Early in the pandemic, many farmers experienced the pandemic-induced disruptions firsthand. Manufacturing shutdowns in Mexico and elsewhere meant that farm machinery parts and components were in short supply. Because most manufacturers operate on a “just in time” manufacturing protocol, there was a lean global stockpile of parts and components.

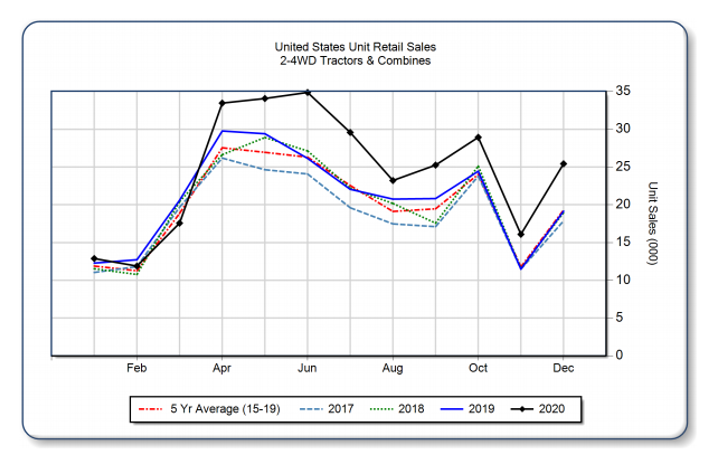

However, Mexico and other countries soon put COVID-19 protocols in place and reopened manufacturing plants. The farm equipment segment, which took a direct hit in March and April, bounced back strongly. The Association of Equipment Manufacturers’ (AEM) December 2020 Ag Tractor and Combine Report shows that demand for tractors of all sizes is up 33.7 percent from the same time in 2019.

Why the surge in demand for equipment? Bluntly, the answer is money. Buoyed by stronger commodity prices and more than $32.8 billion1 in subsidies from the federal government, many farmers have money to spend, and for many, that means investing in equipment.

But financial experts warn farmers to beware: many of those hefty government payments will disappear in 2021 and could have a significant impact on farm income. While it’s good to invest in needed equipment, don’t overdo it.

“The subsidy payouts in 2020 have been an extraordinary income event for a lot of farmers,” explains Jay Landell, a Regional Manager with Ag Resource Management. “When we sit down to do our year-end analysis with our customers, we need to make sure and back out those subsidies from their forecast income for 2021, and then plan around that loss. It will affect the farmers’ break-even costs.”

Landell urges farmers to be both proactive and pragmatic in developing their financial plans for the new year.

“It’s time to meet with your financial partner to analyze what your true breakeven will be for 2021, what financial obligations you have and what your true income potential is for the coming year,” he says. “The subsidies provided a much-needed injection of cash into many farmers’ balance sheets, but farmers need to assume these payments will come to an end in 2021 without any further stopgap subsidies being put in place. It’s never been more important to work with an expert to structure an effective plan for success in 2021.”