After more than five years of a stagnant ag economy, the industry is ready for the cycle to turn upward again. The recent signing of the USMCA trade agreement and phase one re-engagement of trade with China could give the agricultural market the boost it’s been looking for. “Both trade deals provide an opportunity for commodities to see prices begin to move higher,” says Leroy Startz, director of market channel development at Ag Resource Management (ARM).

A rebound in commodity prices is good news for all ag interests, but the potential effects of these deals become magnified for farmers partnered with ARM for crop financing. ARM’s model is based on a forward-looking revenue stream. “If prices go up, it means a higher projected revenue,” says Startz, “which translates into more loan dollars to produce the crop.” For a farmer who had to cut back on fertilizer or pass on soil improvements because of a tight budget, this flexibility can become significant. Rising prices allow ARM to review its revenue projection for the crop and extend more operating credit to the farmer, which can finance the additional crop support needed to maximize yield potential.

Ag Rebounds: What is it and what does it look like…

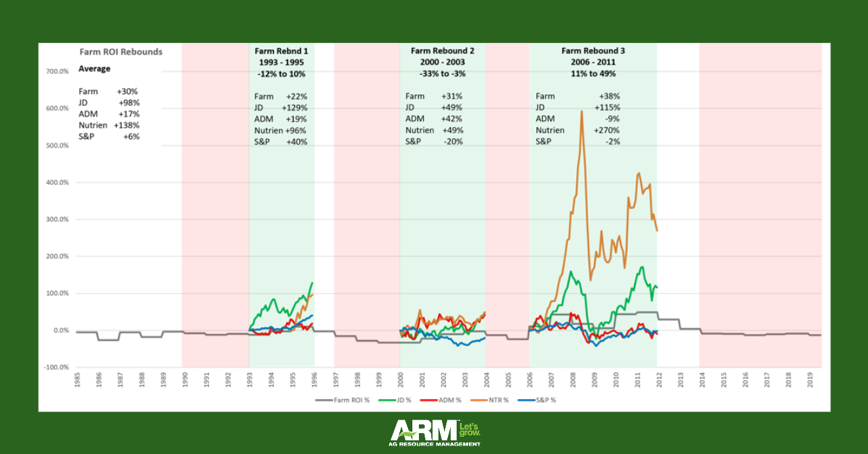

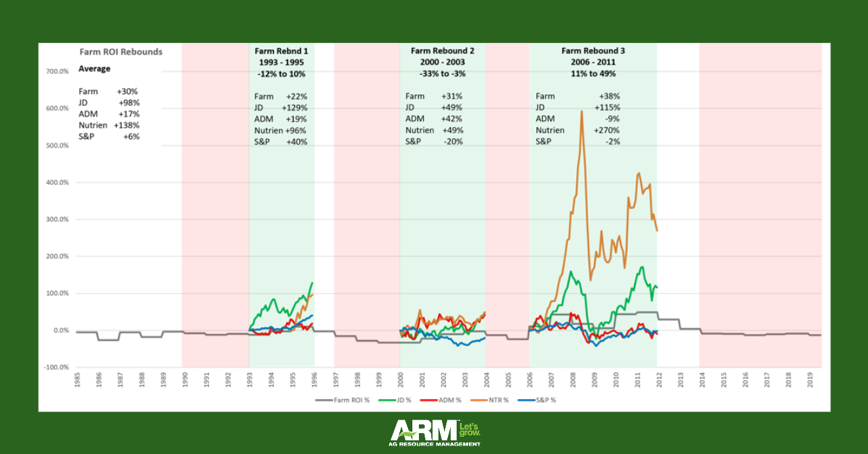

Some say a rising tide lifts all boats. That is particularly true in agriculture. During down cycles, farmers will delay purchases of equipment & machinery and postpone applications of soil nutrients in an effort to preserve cash to keep farming until the next up cycle. Likewise, during the up cycle periods, the farmer will replace old equipment and make new purchases along with crop input purchases to replinish soil nutrients. These purchases represent pent up demand and are made by farmers when cash flow permits.

A look at several companies returns finds the same period of boom and retrenchment. Let’s define the boom to bust years’ and lay this over financial data for several leading Ag companies. In this study we looked at John Deere, ADM, and Nutrien. For the farmer who has mined equity, depreciation, nutrients, and investment in the intervening down cycle, a boom creates a new cash infusion with a tax liability, which often encourages reinvestment into the farm operation. The result is intense returns to Ag companies coming out of a down cycle, especially when compared to the S&P during the same rebound time period.

Has Equity Left the Room?

Given the last five to seven years of flat-to-declining commodity prices, farmers have faced a break-even living at best. “They’ve had to chew up their liquidity to remain farming,” says Startz. The results show up in their balance sheets as declining equity. After depleting cash reserves, farmers often tap the equity in land and equipment to bridge the gap between harvest revenue and paying off their operating line from the prior year. That loss carries forward into the new year, along with the hope that prices will rebound and get them to break-even.

“Farmers now go to their banks with deteriorated balance sheets and cash flows that make the banker uneasy,” he explains. “Increasingly, farmers are no longer eligible to borrow at that bank, and they’re looking for alternative financing solutions. That’s where ARM can help.”

ARM doesn’t look at balance-sheet equity and doesn’t need to take mortgages on land or liens on equipment. Using the forward-value of the crop being planted puts ARM in a unique position to provide farmers with a crop-financing solution that isn’t available from traditional lenders.

“ARM makes it easy and simple for the producer: Bring us your APH, and we’ll find the right crop insurance policy and build a budget that maximizes the revenue stream from the acres you want to plant,” says Startz.

Pushing Out of the Ag Recession?

There’s strong sentiment that the recent trade deals could start to push agriculture out of its recession, but a one-year price rebound is not going to fix years of balance-sheet deterioration. Agriculture is going to be in a healing process for an extended period.

“It’s going to be a slow slog to get back to where we want to be,” he says. “As prices improve, we can get more operating dollars in the farmers’ pockets, which can help accelerate recovery.”

Work is also underway to bring better trade opportunities to the US with the UK and Europe. But the current breakthroughs will offer market confidence, and we should begin seeing pricing improvement, notes Startz.

“Over time, that will help farmers rebuild their balance sheets. While healing takes place, ARM is a solid partner that can help maximize farmer’s operating capital,” he says. “Let’s put a budget together that works for you, and let’s start farming together.”