February 28, 2022 – Fort Worth, TX

One of most frequent questions that Ashley Arrington, Real Estate Division Manager at Ag Resource Management (ARM), gets asked as she’s talking to farmers is “Where are interest rates heading?”

One of most frequent questions that Ashley Arrington, Real Estate Division Manager at Ag Resource Management (ARM), gets asked as she’s talking to farmers is “Where are interest rates heading?”

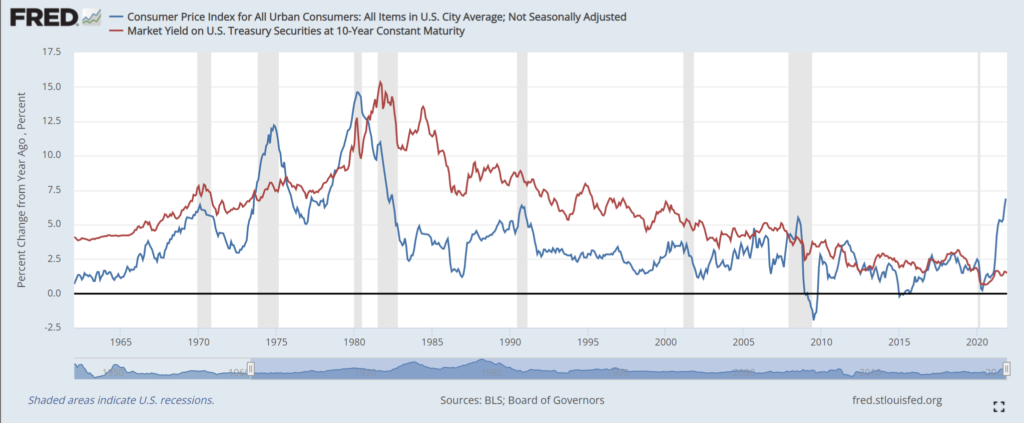

While long-term fixed rates have already started to see an uptick, prime hasn’t jumped higher just yet.

“We’ve seen a little bit of an increase on the short-term loans, but nothing like we have seen on a 30-year fixed loan which is somewhat of a predictor of what we think the market’s going to do over time. We expect rates are going to rise higher in the long-term, than the short-term interim,” said Arrington.

The next question she’s asked is “What can I do about rising interest rates?” None of us have the power to stop rates from increasing, but you can consider proactive actions to help protect your financial interests. Think back to 2012-2013 – that was the last up cycle in commodity prices, and a lot of land was purchased around that time. Many of those loans are now coming up for renewal, so those are important to look at right now.

“Even if it is another year or two before your loan matures, it’s a good time to take a look and explore your options, regardless of if it costs more in the short-term,” she said. “If you’re locked in at 3.8% but your loan doesn’t mature for another 18 months, it’s worth looking at locking in at 4%, which is 20 basis points higher. Because in 18 months, there’s a good chance that rates are going to be a lot higher. The indication from the Federal Reserve is that there could be as many as four to five rate hikes this year, and they have said that it may not be a 25-basis point (0.25%) hike at a time – it could be 50 basis points (0.5%) at a time.”

For example, if you’ve been renting ground and have spoken to the landowner about purchasing the ground in the next few years, now may be the time to make the purchase. If you wait two to three years then make a move to purchase and finance it, the interest rate could be significantly higher. Land values are also high, and land values and interest rates are typically correlated.

Interest rates are headed higher due to inflation in the market. Higher inflation is impacting everything from the housing market to items you buy at the grocery store to input costs for crop farmers. Inflation is inherently tied to interest rates, and they work like checks and balances for each other. Historically, when land prices hit a certain level, interest rates are going to move higher.

“We’re seeing a lot of inflation in the market right now, and the only thing keeping land prices at bay is interest rates. If there’s a rate hike of 100 basis points from where they are now, we may see the top end of the land value bubble. Look to get land purchases completed and refinancing done ahead of that,” Arrington said. “Speaking to experts in the industry, many say when we hit a hike of 200 to 250 basis points, that’s the trigger for the land value bubble to pop.”

Rented land should also be monitored as interest rates move higher. Rents will inevitably move higher. More and more institutional land buying is occurring, and those buyers want to rent their land while seeing a strong ROI. If they finance a portion of the purchase, then their payment will go up so rental rates may start to climb.

“We’ve seen an increase in rental prices, not because of interest rates, but because of higher land and commodity prices,” she noted. “Next year, we’ll probably see increases related to interest rates, especially with farmland that is changing hands.”

To protect your financial interests, make plans to look at:

1) Refinancing any maturing loans – run the numbers and see if it makes economic sense to refinance before rates go up

2) Planned purchases – any purchases for the farm like land, equipment, vehicles, etc. that you had planned to purchase in the next three years

3) Operating loans – review your operating loan and ensure your lender offers fixed rate loans

4) Rented land – rental rates could easily go higher., so plan accordingly

5) Overall financial situation – do a stress test with what you have. For example, if you have real estate loans, what happens if rates do go up 200 basis points – how does that stress your cash flow?

Learn more about our real estate loan services by contacting your nearest ARM location.