We’re at the 2021 Farm Science Review this week! Area Manager Elizabeth Long sits down with the Ohio’s Country Journal and Ohio Ag Net team to highlight this week’s events, including Wednesday’s featured guest Rich Morrison.

Author: Matthew Marr

AG RESOURCE MANAGEMENT COMPLETES LANDMARK SECURITIZATION FOR AGRICULTURAL FINANCE SECTOR

FORT WORTH, TX — Ag Resource Management (ARM), one of the nation’s top providers of agricultural lending and risk management services, announced that it successfully closed on the first securitization of its type in the agriculture industry. The 144A offering of $225 million crop loan backed notes serves as a milestone for ARM and the industry by accessing new sources of financing for ARM’s crop loan product. Guggenheim Securities, LLC acted as sole structuring advisor and sole bookrunner.

“The past decade has been a challenging one for agriculture. Farmers need crop collateral solutions that work in a manner conducive to their success,” said ARM’s Chief Executive Officer, John Hoffman. He added, “Here at ARM, we are far from the norm. ARM is simply the smart choice for any farmer.”

The master trust securitization allows ARM to match fund its obligation to its farmers’ needs and to enable better execution, which will in turn allow further reach and more competitive capital solutions for the farming community.

“The successful completion of this inaugural asset-backed security transaction represents a significant milestone for Ag Resource Management in opening access to new sources of efficient capital that enables us to better serve the financing needs of farmers and agribusiness,” said ARM Chief Financial Officer and President of Capital Markets Rasool Alizadeh.

“Ag Resource Management’s goal has always been to keep farmers farming. It is a privilege for Guggenheim Securities to bring ARM to the debt capital markets through an innovative asset-backed security that helps ARM connect and partner with farmers across the country while also meeting the needs of the investor community,” said Cory Wishengrad, Head of Fixed Income for Guggenheim Securities.

The Secured Notes and the related note guarantees were offered in a private offering to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”) and to non-U.S. persons in accordance with regulations under the Securities Act. The Exchangeable Notes and the related note guarantees were offered to qualified institutional buyers pursuant to Rule 144A under the Securities Act. The Notes, the related note guarantees and any shares of common stock issuable upon exchange of the Exchangeable Notes have not been, and will not be, registered under the Securities Act or any state securities laws. The Notes, the related note guarantees and any such shares may not be offered or sold in the United States or to, or for the benefit of, U.S. persons absent registration under, or an applicable exemption from, the registration requirements of the Securities Act and applicable state securities laws.

This press release does not constitute an offer to sell or the solicitation of an offer to buy the Notes or any other security and shall not constitute an offer, solicitation or sale in any jurisdiction in which, or to any persons to whom, such offering, solicitation or sale would be unlawful.

About Ag Resource Management

Founded in 2009, Ag Resource Management (ARM) is a specialty finance company bringing financial and risk management solutions to farmers and agribusinesses. Our teams are highly specialized in agricultural finance and crop insurance. We combine that with proprietary lending technology and a deep understanding of crop agriculture to build a customized strategy for every farming operation. It started as just one office in the Louisiana Delta, and now, headquartered in Fort Worth, Texas, ARM’s footprint has expanded to serve customers from 29 field locations in 18 states. They are led by experienced leaders in the agriculture industry who are committed to every operation’s growth and success.

Media Contact:

Matthew Marr

mmarr@armlend.com

682-302-3361

SOURCE Ag Resource Management

In the competitive world of agricultural finance, there are alternatives to a traditional bank loan for farmers to consider. But why? What are the differences between a traditional bank loan and getting a loan through Ag Resource Management? Let’s dive into the details.

Comparing Loan Processing and Approval

Most banks are insured by the Federal Deposit Insurance Corporation (FDIC), which means their loans (including agricultural loans) are insured through this independent federal agency. However, being insured by the FDIC also means these banks have more complex processes for making loans and more restrictions on the various types of loans they can make.

For example, an FDIC Financial Institution Letter issued to FDIC-regulated banks in January of 2020 reads (in part), “As headwinds facing the agricultural economy persist, insured institutions must be prepared for agricultural borrowers to face financial challenges by employing appropriate governance, risk management, underwriting and credit administration practices.” You can read the entire letter here: https://www.fdic.gov/news/financial-institution-letters/2020/fil20005a.pdf.

The letter goes on to outline additional recommendations for increased oversight and regulation of agricultural loans.

In other words, the tighter the ag economy becomes, the more FDIC-insured institutions are pressured to increase scrutiny of ag loan applications, ask for more documentation and overall, tighten the criteria for approving agricultural loans.

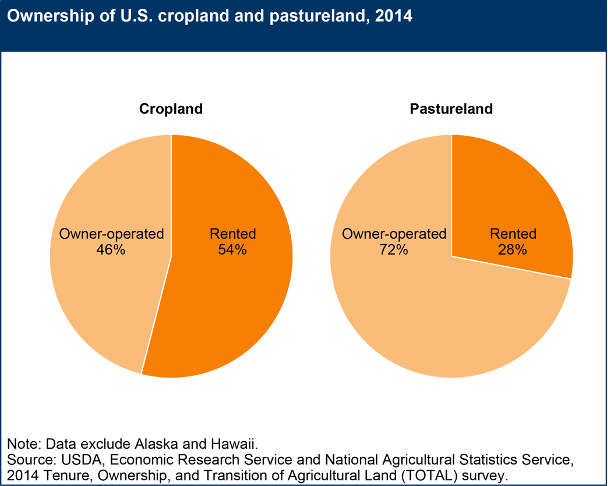

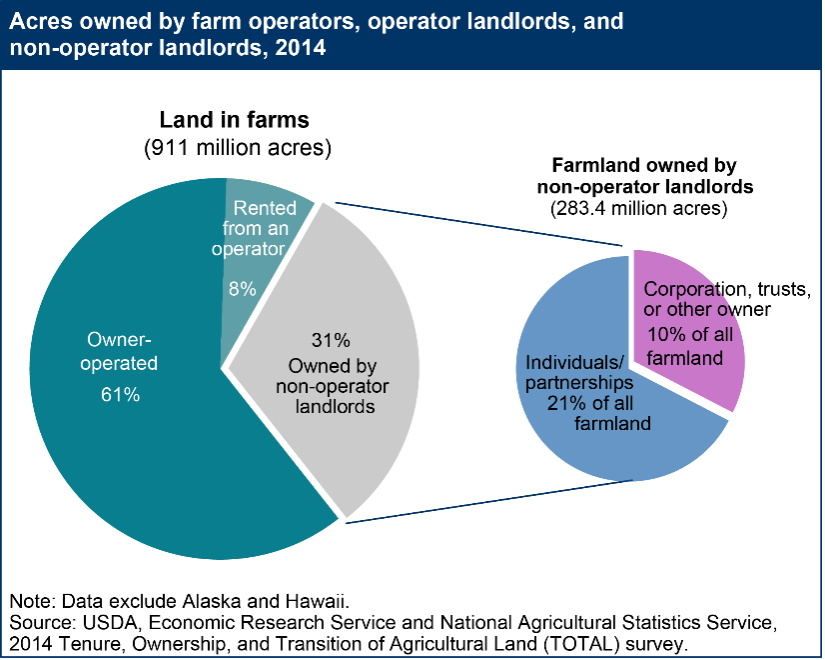

In addition, most agricultural loans approved by banks are based on the farmer’s real estate and equipment equity. Younger farmers, or farmers who rent versus own most of their acres, and thus have lower equity, might find it challenging to get approval for a bank loan.

Traditional bank loans also rely heavily on the historical income of the farming operation. This presents another challenge for a new farmer, who doesn’t have a proven history of producing profitable crops and successful farm management.

“They don’t have equity in real estate, which most young farmers don’t because they don’t own the land they are farming,” explains Don Hastings, an area manager with Ag Resource Management based in Dexter, Missouri. “They’re going to be very limited in their equipment because they’re just starting and making payments on that, so again, low equity. To get a bank loan, many of them would have to go back to their parents or relatives to secure the note that they are a co-signer and co-guarantor of the loan.”

This is where the Ag Resource Management (ARM) loan process differs significantly from those used by traditional lenders. Area Manager Jason Brown, who is based in Waunakee, Wisconsin, explains.

“Our product is tailored to those who don’t have real estate equity, and that lack of real estate equity could be for a variety of reasons,” says Brown. “The business model of farming has changed over the years; and in today’s crop production world, farmers are renting or leasing the majority of their land. That may be because they’re just starting out, or they are expanding their operations and they’re leasing land to grow, and the equity that they do have just isn’t enough for the size of the farm that they need.”

The ARM loan process looks at the value of the crop that’s going into the ground this planting season and government payments crop insurance and then provides loans based upon that future crop value, not on equity.

“We’re more interested in determining the future value of that crop and lending against that whereas the bank is more interested in looking at hard assets,” explains Brown. This means there are significant benefits for farmers who get loans through ARM.

The Benefits of Working with ARM

Two of the key benefits of getting a loan through ARM are freedom and flexibility.

“We turn the farmer back into a cash buyer,” says Brown. “If you don’t get a bank loan, you can consider a loan from a co-op, who’s going to sell you inputs like seed, fertilizer or chemicals. But financing through them means you’re committed into buying inputs from whichever institution will give you credit, and that limits your choices. Your ability to compare prices or purchase the right inputs for what your acres need is reduced. And you’re tied to paying whatever price they are going to sell it to you at. If you have a loan through ARM, you have the freedom to make the right choices for your farming operation and the ability to shop around for the best prices.”

The freedom of an ARM loan also means farmers can pay for things that a co-op isn’t interested in financing.

“We give farmers options,” says Brown. “The co-op isn’t going to finance rents, for example. It may not finance labor and repairs. That leaves the farmers with the additional job of figuring out how to finance those things on their own. We give them a way to finance all of those things.”

Another advantage of working with ARM is that it gives the farmer a knowledgeable financial partner to help them evaluate different financing offers, to construct a financing package that will be most beneficial for their operations. ARM financial experts can help farmers evaluate offers on seed or equipment financing, for example, and make those part of the farmers’ overall financial management plan.

“There are times when working through a supplier, such as your seed company, makes sense,” says Brown. “We’re here to help the farmer determine when that makes sense and when it doesn’t. For example, if the seed company is willing to finance your seed on an unsecured basis at a reasonable rate, let’s use that. That way it frees up some dollars for me to help you in another way. We help farmers create these custom financing packages, and we help them manage that process.”

“That’s a key difference between the way we work at ARM and the way a traditional lender works,” says Hastings. “We’re able to connect with the input suppliers and perhaps get the farmer some additional credit there and work out a partnership deal. We can work with a banking partner and help them get their equipment payments built into our budget. There are so many different ways that we can package deals and offer them solutions. It’s a very well-rounded approach. We look at everything.”

That kind of hands-on partnership with farmers is another key advantage of working with ARM. ARM financial experts monitor the details. And that can save their customers from financial disaster.

“For example, if I have a customer who normally plants 2,500 acres, initially his loan was based on planting that many acres,” says Brown. “But in 2019, for example, it was a horrible, wet spring. Lots of prevent plant acres, and he only ended up getting 1,600 acres planted, which was the case for many farmers. In late summer, we went over those numbers, and I told him we needed to reduce the loan, so it was based on this lower acreage. He may not have been happy about that at the time. But fast forward to December when we are recapping the year, and he had just enough crop expenses to get his loan paid back. We did the right thing, even though it wasn’t an easy thing to do, and it saved them from being short on their loan.”

Lastly, and this is a big one, there’s the advantage of speed.

It can take weeks or even months to get the final word on a loan from a traditional lender. But because ARM doesn’t need to wait on a real estate or equipment appraisals or other procedures that draw out the loan process, they get farmers the loan money they need much more quickly. In most cases, ARM loans are processed and in the farmer’s bank account in less than a week. And in the dynamic world of crop production, having the money when you need it is crucial.

“Other lenders make decisions by looking at tax returns based on the previous calendar year, among other things,” explains Brown. “The tax year ends December 31, so they might get those tax returns in mid-February or even early March. They need time to digest those financials, so the physical calendar keeps inching closer and closer to planting season, and the farmer doesn’t have the capital to make buying decisions until April or May if they’re working with a traditional lender. On the flip side, I can help them in December and January and get them their money quickly. We give them the capital they need in a timely fashion, so they can be more successful.”

To learn more about the advantages of working with ARM, visit www.armlend.com.

There are a lot of mixed messages on the agricultural finance front these days. For example, on March 31, the USDA National Agricultural Statistics Service (NASS) released its 2021 Prospective Plantings Report, which said that U.S. farmers planned to plant an estimated 91.1 million acres of corn and 87.6 million acres of soybeans in 2021.

- That’s less than 1% more corn acres than were planted in 2020.

- That’s approximately 5% more soybean acres than 2020.

However, those numbers are also LESS than what the USDA had predicted growers would plant in statements made at the 97th annual Ag Outlook Forum, just a month before. The interpretation of the USDA announcement and the acreage predictions varied – some prognosticators said growers planting fewer acres than USDA thought in February would mean tighter grain stores and potentially sustained higher commodity prices. Others said the numbers showed intended plantings were not varied greatly from 2020, unsure if high commodity prices would be sustainable.

Other factors are adding to the turbulent dynamic in global agriculture:

- Experts are still calculating the long-term effect of last February’s deep freeze, especially its longer effects on the fuel, rubber and plastics industries and any other manufacturing that is highly dependent on petroleum.

- In some areas, interest rates, which for months had been at historic lows, are showing signs of creeping upward again – what does that mean for the nation’s crop producers?

- Will the Brazilian harvest be good, bad or indifferent? How will that affect global commodity prices?

In the face of so much turmoil, experts advise growers to stick to best financial practices to allow them to navigate the potentially tricky waters of the upcoming growing season. We talked with Jason Brown, Area Manager with Ag Resource Management, and Ashley Arrington, ARM’s Real Estate Division Manager, about these practices, and here’s what they recommend:

Build Working Capital

Before taking on additional debt, analyze upcoming financial needs and expenses, and work on having enough cash on hand to deal with those “known quantities” without needing a loan.

“Having cash on hand allows a grower to take advantage of opportunities,” explains Brown. “This is especially important in times where commodity prices look good and opportunities, such as land acquisition, will pop up quickly and won’t last long. The grower with a solid source of working capital is going to be able to snap up those opportunities much faster than a grower who has to find financing.”

Restructure Debt

Growers have a tremendous opportunity to restructure debt right now, due to historically low interest rates combined with sustained high commodity prices. In this situation, loaning to growers looks like a good move for most financial institutions.

“Take a look at your debt scenario in terms of your long-term debt,” recommends Arrington. “You might have the opportunity to restructure debt and lock in a lower interest rate and lower payments. Restructuring debt now will help growers get through future downturns in the market by locking in those low interest rates and low payment schedules, which will help them navigate market ups and downs not just in 2021 but in coming years as well.”

Re-Evaluate Break-Even Estimates During the Crop Year

Both Arrington and Brown emphasize that with prices of so many inputs fluctuating, and some distribution chains still experiencing disruption, it’s important for growers to update and re-evaluate their break-even numbers and profit potential throughout the season.

“Growers who need an in-season input—such as a post-emergent herbicide, fungicide, insecticide or additional nutrients—might find that higher-than-expected prices might affect the break-even numbers they calculated back in December or January,” cautions Brown. “We work with our growers to look at that plan throughout the season and make adjustments if prices of needed inputs, fuel or other factors could affect their break-even and potentially, their profitability.”

For more information about how Ag Resource Management can help you with financial planning, financing and risk management, visit www.armlend.com.

So much about agriculture depends upon timing. And if you’re looking to get an operating loan, getting hung up for weeks, or even months, waiting for an answer can mean losing a lot of opportunities.

“Farmers need loans for a lot of reasons,” says Chad Hunter, area manager with Ag Resource Management. “For example, to fund rent, purchase seed or chemicals, fund labor, pay annual obligations such as taxes, you name it. The faster a farmer can get their operating loan in place, the faster they can go ahead and have the peace of mind of knowing they have the funds available to take care of those obligations.”

Having your operating loan quickly in place means opportunity for a grower. That might mean the chance to get an early order deal on inputs like fertilizer or crop protection chemicals, or seed. It might mean the opportunity to rent more land. It can also mean having the money ready when the planting conditions are right, instead of being hamstrung, waiting for loan approval.

“We talk about it in terms of opportunity cost,” explains Hunter. “Let’s say a grower wanted to plant corn, but his lender told him no, after a certain point in May. After a certain point in May, you lose your ability to protect that crop with crop insurance. So, this farmer is forced to plant soybeans instead. In this instance, the opportunity in corn was $150 potential profitability an acre, where in soybeans, that opportunity was only $50 per acre. So, his opportunity cost was $100 per acre. When you multiply that across 1,000 acres, that’s a lot of missed opportunity because he couldn’t get the financing he needed in time.”

Delays at planting time can result in genuine economic loss. According to data released by Pioneer during the 2021 Commodity Classic, growers can lose between .25 and .40 bushels per day in corn yield if planting is delayed after mid-to-late April. A 10-day delay from April 20th to May 1 could result in $24 to $40 of lost yield per acre.1

“Every day you lose after your optimum planting date, depending upon the maturity of your hybrid, you’re losing yield,” says Hunter. “With so many other pressures on a grower running up to planting time, being delayed in getting an operating loan shouldn’t be one of them. I had a grower who wanted to plant 1,000 acres who came to me, saying the lender was taking too long, and could I take a look at his situation. Three days later, I had an approval for him, and two days later, we funded that loan. So, he had the ability to go out and get his seed, his crop protection chemicals, make his planting plan and get that corn in the ground.”

That’s a prime example of one of the key benefits of working with Ag Resource Management (ARM)—speed.

“We’ve figured out how to leverage the crop and crop insurance, to maximize cash flow and risk management to provide a more streamlined underwriting and closing process, as well as a more efficient plan for the grower to use throughout the year,” says Hunter. “Our speed, our strategies and our solutions that come from our underwriting platform are bar none, the best in the industry. A farmer is never waiting on ARM to get it done.”

So why wait? To find out more about Ag Resource Management and locate an ARM representative near you, visit www.armlend.com.

1 “Busting Two Myths Can Make Corn Farmers $120 Per Acre,” Gil Gullickson, Successful Farming, (March 2, 2021)

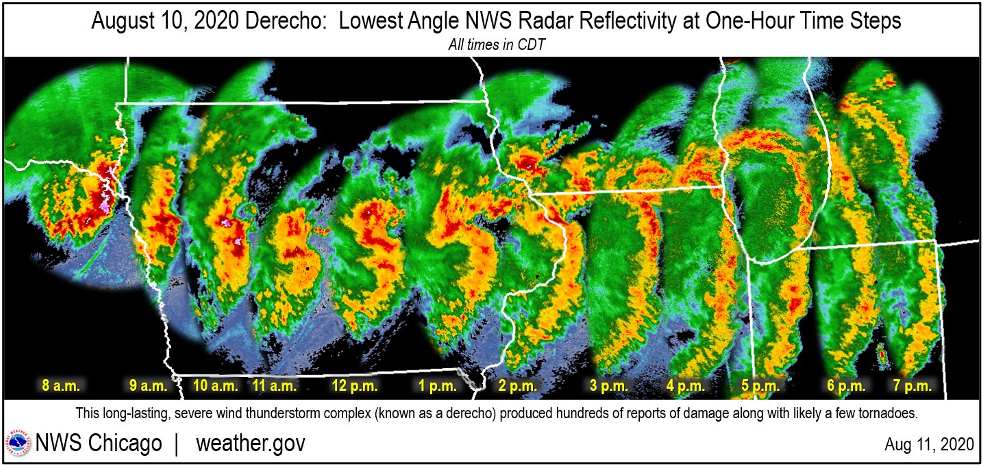

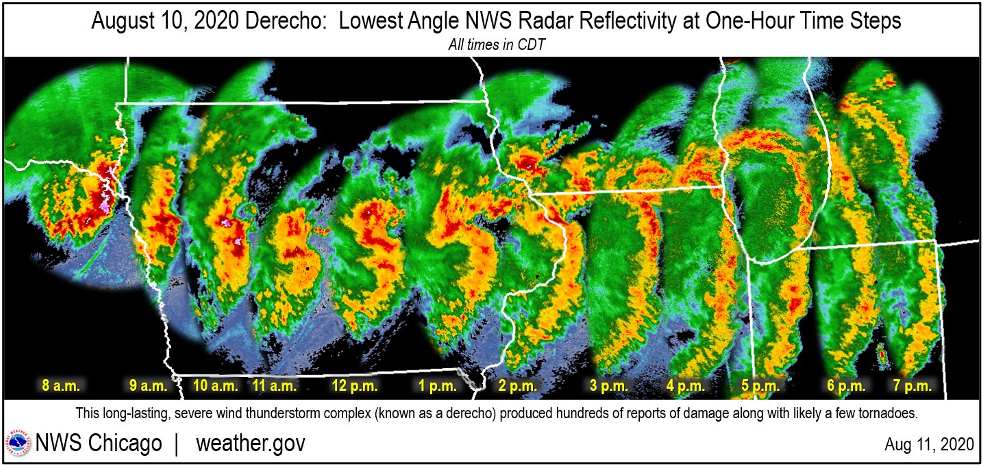

The year of 2020 was certainly been one for the record books – and we’re not just talking about the COVID-19 pandemic. It has brought us some of the wildest, most unpredictable weather events in recent history. One event in particular, a derecho storm that smashed through the Midwest on August 10, 2020, caused damage in Illinois, Ohio, Minnesota, Iowa and Indiana.

According to the National Oceanographic and Atmospheric Administration (NOAA), the derecho was the second-costliest U.S. disaster in 2020, impacting 37.7 million acres of farmland across the Midwest – 14 million of those in Iowa alone, according to the Iowa Soybean Association.

The costliest U.S. disaster of 2020? Well, that was Hurricane Laura, which caused $14 billion in damage when it ravaged the Gulf Coast in August, according to NOAA. In fact, Laura was one of twelve named storms (yes, that’s a record) and six record-tying hurricanes to hit the United States in 2020.

These devastating weather events caused headaches for farmers in many ways, including loss of crops and lower yields due to crop quality issues, extended harvest time, potentially the need for specialized equipment to pick up downed corn and other crops, increased fuel and labor costs and other unanticipated expenditures that could turn a banner year into a financial disaster in the course of a few weeks.

According to risk management experts with Ag Resource Management, these events bring up an important reminder: It’s time to start moving forward from 2020.

“It’s absolutely critical for growers to re-evaluate their risk management plan every single year,” says Matt St. Ledger, an Area Manager with Ag Resource Management based in Haubstadt, IN. “Every year, new insurance products become available, and those need to be evaluated. Some years, new or different adjustments are allowed on your Actual Production History (APH) calculation. A farmer’s crop mix can change year over year. There’s a lot to be evaluated each year to make sure the risk management plan is going to cover the farming operation adequately.”

Before beginning the process of calculating risk management, it’s important to select the right experts to partner with, according to Billy Moore, President of Insurance at Ag Resource Management.

“In terms of risk management, the grower wants to avoid having multiple agents covering different areas of the operation,” he says. “It’s critical that their risk management plan evaluates and manages the risk in every part of their farming operation. That’s the way we approach our clients. Everything we do is aligned toward achieving those overarching goals.”

In addition to this alignment, farmers need to work with a risk management partner who will customize a risk management plan specifically to their farming operation’s needs. Ag Resource Management takes a unique, proactive approach to lending and risk management.

“A balance sheet is what has been,” says Moore. “Looking at your APH, your crop insurance policy, your planting intentions and any contracts you may have, that’s looking at what can be – it’s looking at the potential of a specific farmer’s operation. We lend money based upon that potential.”

Another thing that makes Ag Resource Management unique is the ag lending technology that it uses to evaluate a farm operation’s potential.

“We have the ability to see farm by farm, acre by acre, what the best potential for that farming operation is,” says St. Ledger. “The technology allows us to dive into deep detail on any specific farm, looking at the best potential crop mixes and risk management plan to produce the best potential profit for that operation. We know every farm has its own unique potential, and that’s what we gear our lending and risk management planning toward.”

Moore and St. Ledger laid out a step-by-step plan they follow with clients when planning for the upcoming crop year:

Step One: Get Your APH Adjustment Correct Now

“A lot of things have been added this year to the APH calculation, such as the quality loss option that will address some of those quality issues,” says Moore. “It allows the growers to be able to use their pre-adjusted yield calculation into their APH, and that’s going to be a big feature that’s going to benefit those who had quality issues.”

For example, new for the 2021 crop year, the Quality Loss Option (QL) allows exclusion in quality loss from an APH database in circumstances where a quality loss occurs. Get a fact sheet on the Quality Loss option at https://www.rma.usda.gov/en/Fact-Sheets/National-Fact-Sheets/Quality-Loss-Option.

For those whose losses came through production versus grain quality, there are other adjustments in the APH calculation that can be made.

In addition to adjusting the farm’s APH, Ag Resource Management will review other critical information such as the farm’s FSA-578 annual acreage report form, the operation’s budgets, projected input costs and other key factors.

Step Two: Analyze the Good and Bad of 2020

It’s always uplifting to recount the successes of each crop year. However, it’s even more critical to evaluate what didn’t go so well.

“You have to be willing to look at what went wrong as well as what went right,” says St. Ledger. “New revenue products will start coming out in December. That’s why it’s important to work with your risk management partner to have an analysis done of your farm operation, so you’ll be in the best position to evaluate these new products when they start rolling out.”

Step Three: Evaluate New Offerings

Step three, says Moore, is evaluating these new products. Are they necessary to cover any “risk gaps” in the operation and reduce exposure? This is another area where having a forward-looking, experienced risk management partner, like Ag Resource Management, is crucial.

“I tell every grower I sit down with that it’s my job to find where those exposures or risk gaps are,” says Moore. “We want to take out the minimum amount of insurance needed to put them into a position where they can pay their bills and go farm for another year. That’s our business – to help you keep that farming operation going year after year.”

For more information, contact your nearest Ag Resource Management area manager or visit armlend.com.

As the COVID-19 pandemic swept around the globe in 2020, it forced business and manufacturing shutdowns that disrupted industries far and wide – and agriculture was no exception.

Early in the pandemic, many farmers experienced the pandemic-induced disruptions firsthand. Manufacturing shutdowns in Mexico and elsewhere meant that farm machinery parts and components were in short supply. Because most manufacturers operate on a “just in time” manufacturing protocol, there was a lean global stockpile of parts and components.

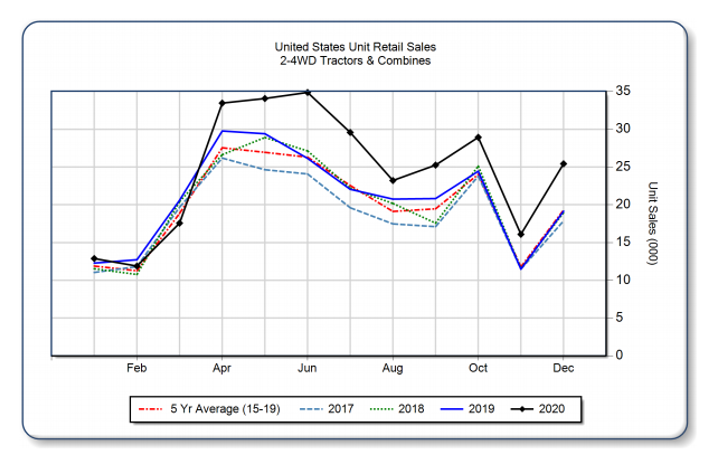

However, Mexico and other countries soon put COVID-19 protocols in place and reopened manufacturing plants. The farm equipment segment, which took a direct hit in March and April, bounced back strongly. The Association of Equipment Manufacturers’ (AEM) December 2020 Ag Tractor and Combine Report shows that demand for tractors of all sizes is up 33.7 percent from the same time in 2019.

Why the surge in demand for equipment? Bluntly, the answer is money. Buoyed by stronger commodity prices and more than $32.8 billion1 in subsidies from the federal government, many farmers have money to spend, and for many, that means investing in equipment.

But financial experts warn farmers to beware: many of those hefty government payments will disappear in 2021 and could have a significant impact on farm income. While it’s good to invest in needed equipment, don’t overdo it.

“The subsidy payouts in 2020 have been an extraordinary income event for a lot of farmers,” explains Jay Landell, a Regional Manager with Ag Resource Management. “When we sit down to do our year-end analysis with our customers, we need to make sure and back out those subsidies from their forecast income for 2021, and then plan around that loss. It will affect the farmers’ break-even costs.”

Landell urges farmers to be both proactive and pragmatic in developing their financial plans for the new year.

“It’s time to meet with your financial partner to analyze what your true breakeven will be for 2021, what financial obligations you have and what your true income potential is for the coming year,” he says. “The subsidies provided a much-needed injection of cash into many farmers’ balance sheets, but farmers need to assume these payments will come to an end in 2021 without any further stopgap subsidies being put in place. It’s never been more important to work with an expert to structure an effective plan for success in 2021.”

2020 was one for the record books – and we’re not just talking about the pandemic. 2020 featured some of the wildest, most unpredictable weather events in recent history. One event in particular, a derecho storm that smashed through the Midwest on August 10, 2020, caused damage in Illinois, Ohio, Minnesota, Iowa and Indiana.

According to the National Oceanographic and Atmospheric Administration (NOAA), the derecho impacted more than 37.7 million acres of Midwestern farmland – making it the second most costly natural disaster of the year.

The costliest U.S. disaster of 2020? That title goes to Hurricane Laura, which caused $14 billion in damage when it ravaged the Gulf Coast last August, according to NOAA. In fact, Laura was one of twelve named storms (yes, that’s a record) and six record-tying hurricanes to hit the United States in 2020.

While these events caused farmers a variety of headaches, risk management experts advise that it’s time to move forward and plan for a successful 2021. So what’s the first step?

“It’s absolutely critical for growers to re-evaluate their risk management plan every single year,” says Matt St. Ledger, an Area Manager with Ag Resource Management based in Haubstadt, IN. “Every year, new insurance products become available, and those need to be evaluated. Some years, new or different adjustments are allowed on your Actual Production History (APH) calculation. A farmer’s crop mix can change year over year. There’s a lot to be evaluated each year to make sure the risk management plan is going to cover the farming operation adequately.”

Before beginning the process of calculating risk management, it’s important to select the right experts to partner with, according to Billy Moore, President of Insurance at Ag Resource Management. Find a risk management partner who will customize a risk management plan specifically to your farm operation’s needs.

“We have the ability to see farm by farm, acre by acre, what the best potential for that farming operation is,” says St. Ledger. “The technology allows us to dive into deep detail on any specific farm, looking at the best potential crop mixes and risk management plan to produce the best potential profit for that operation. We know every farm has its own unique potential, and that’s what we gear our lending and risk management planning toward.”

Moore and St. Ledger laid out a step-by-step plan they follow with clients when planning for the upcoming crop year:

· Step One: Get Your APH Adjustment Correct Now

· Step Two: Analyze the Good and Bad of 2020

· Step Three: Evaluate New Offerings

“I tell every grower I sit down with that it’s my job to find where those exposures or risk gaps are,” says Moore. “We want to take out the minimum amount of insurance needed to put them into a position where they can pay their bills and go farm for another year. That’s our business – to help you keep that farming operation going year after year.”

For more information, contact your nearest Ag Resource Management area manager or visit armlend.com.

Where did your farm’s equity go? Over the last four to five years, the agriculture economy has stagnated, and commodity prices have dropped. We’ll explain why this has caused many farmers to lose equity and left them struggling to secure capital needed to keep farming.

Liquidity is working capital. Liquid funds include savings and other assets you can turn into cash quickly to help cover costs when an expense arises — either planned or unplanned. Your balance sheet also lists intermediate-term assets, such as equity built up in equipment, and longer-term assets represented by land or real estate equity.

Strong commodity prices allow farmers to buy or trade equipment on a regular basis to collect the tax deduction created by accelerated depreciation. As the ag economy slows, some farmers have to slow or stop that purchasing cycle, leaving them to manage high equipment payments without the benefit of the accelerated tax deduction. Furthermore, low commodity prices reduce the cash flow they count on to keep up with payments.

A weak economy also slows equipment sales, creating a drag on equipment value. This catches famers in a double-jeopardy situation as depreciation piles up. Thus, the equity in farm equipment begins to shrink — even while farmer stays current on the payments. This grim combination of circumstances makes it difficult for equipment to hold its value and negatively affects the farmer’s position in securing future deals.

From the standpoint of land, equity erosion can even affect farmers who built equity through many years of consistent payments or through inheritance. Losses in recent years have depleted many farmers’ short-term liquid assets. Banks watching those losses pile up may ask producers to rebalance their assets. Farmers can inject cash (liquidity) back into the operation by selling some land (which either reduces potential harvest volume or increases overhead through rental fees) or by refinancing their land to convert some equity into cash, which stretches their payments farther into the future.

Low commodity prices can even limit the ability of farmers possessing plenty of land equity to benefit from a refinance deal. When sitting down with a banker to work out cash flow, what remains to produce the coming year’s crop after overhead, land and equipment payments may not add up. There simply may not be room to increase land payments by $10,000 or $20,000 in a weak ag market.

PARTNERING WITH COMMUNITY BANKS

Community bankers know the challenges presented by struggling farming operations. Look to Ag Resource Management (ARM) as a partner for creating strategies that manage risk for you and your farmer customers.

A troubled loan puts a bank in a precarious position: It must either refuse a request for additional funding or extend more capital into a loan that’s already troubled. Neither scenario holds much appeal.

ARM can help banks address efficiency and performance by managing some of the risk in their ag-loan portfolio. ARM can offer alternative financing that allows farmers to plant their crops, move forward with the season and continue generating income — and the bank won’t have to advance further capital.

Banks have historically made operating loans based on real estate assets, but many farmers now own only a small piece of land and lease most of their acres. Because ARM relies on this season’s crop for collateral, ARM can take on the operating loan while banks continue to manage equipment and real estate term debt.

“Sometimes bankers need somebody to stand with them in order to provide the farmer an operating loan to farm that year — that’s where ARM comes in.” -Gerald Kruger, Area Manager for Sioux Falls, SD

BENEFITS FOR COMMUNITY BANKS

Partnering with ARM offers community banks many benefits:

- Improve the balance sheet and financial performance.

- Maintain relationships using a sustainable plan and without increasing commitment in a regulatory environment that may advise exiting the relationship.

- Continue existing relationships in a tough landscape for finding new customers.

- Reduce reputational risk. Offering a path forward shows that a bank wants to offer value to and help its farmers, thereby avoiding the appearance of marginalizing its farming client base.

ARM assistance creates a path forward for a troubled farming operation. Often, these clients just need to get through a rough spot. ARM can bridge the gap and give the farmer time, while helping the bank preserve the long-term relationship with that customer.

If the path forward for a farming operation is bleak, then ARM’s involvement for a year can offer everyone time to plan an orderly liquidation. The farmer and the bank usually come out better given the extra time.