Fort Worth, TX – March 21, 2022

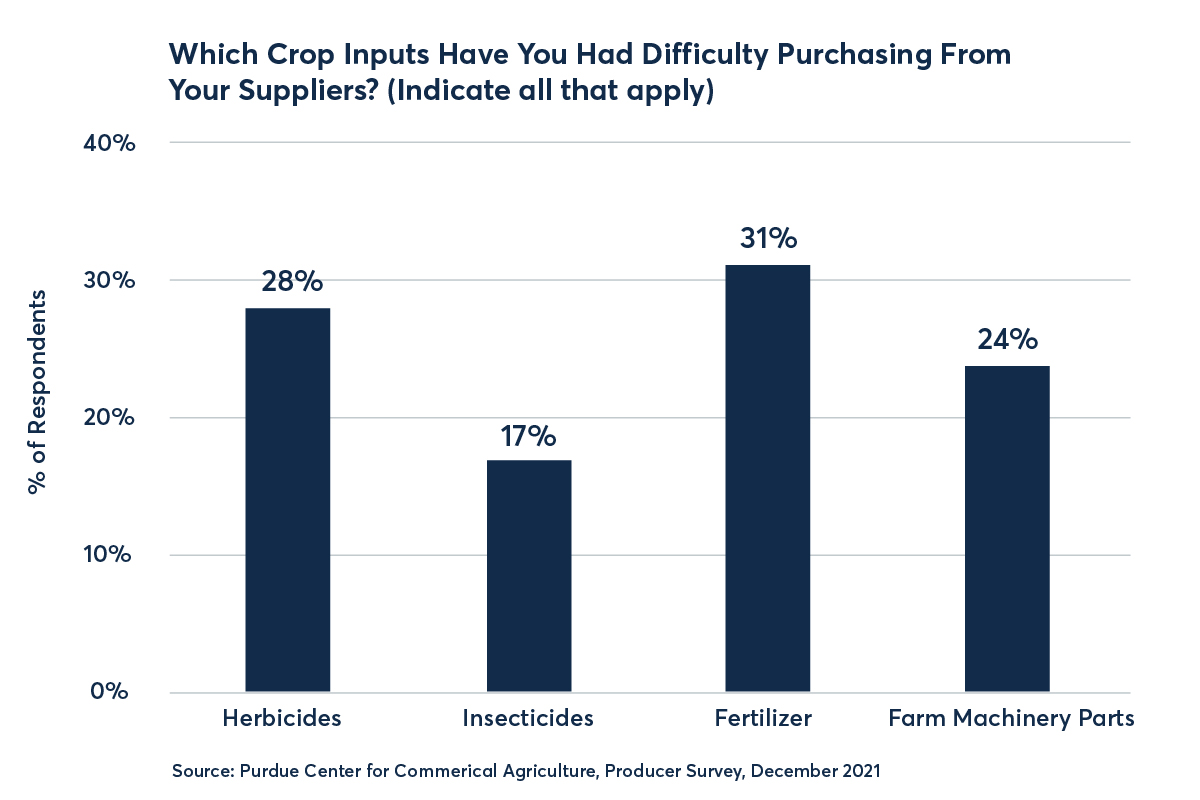

Input costs are expected to be variable in 2022, and that’s putting it lightly. Some inputs like fertilizer have risen 60% to more than 100% from year-ago levels and are expected to remain high for the next 18-24 months. While seed and chemical costs appear steady to slightly higher.

“When considering a farmer’s operating line, the variability, or perhaps volatility, in cost is the biggest concern we’re seeing,” said Elizabeth Long, Area Manager at Ag Resource Management (ARM). “An operating line renewal is beneficial because ARM can close these lines and make funds available to farmers today, especially with an all-in program. So, I can close an operating line today, and our customer can write a check tomorrow to their input supplier.”

“When considering a farmer’s operating line, the variability, or perhaps volatility, in cost is the biggest concern we’re seeing,” said Elizabeth Long, Area Manager at Ag Resource Management (ARM). “An operating line renewal is beneficial because ARM can close these lines and make funds available to farmers today, especially with an all-in program. So, I can close an operating line today, and our customer can write a check tomorrow to their input supplier.”

The typical ARM process to complete an operating renewal is three business days from start-to-finish, so the customer has access to their cash much quicker than they would from a traditional lender who must go to a board for approval. Thus, it’s easier to work with ARM to get cash in-hand quicker and take delivery on fertilizer and chemicals in a timelier manner.

ARM recommends farmers process their annual operating line renewal anytime from December through March because an earlier operating line renewal also offers buying power. The opportunity to purchase inputs early and get them stored or ready to apply is especially critical this year. Traditional lenders may require details like gross farm income from a tax return which likely won’t be available until mid-March. ARM works differently, making their decisions more heavily weighted on level of crop insurance coverage.

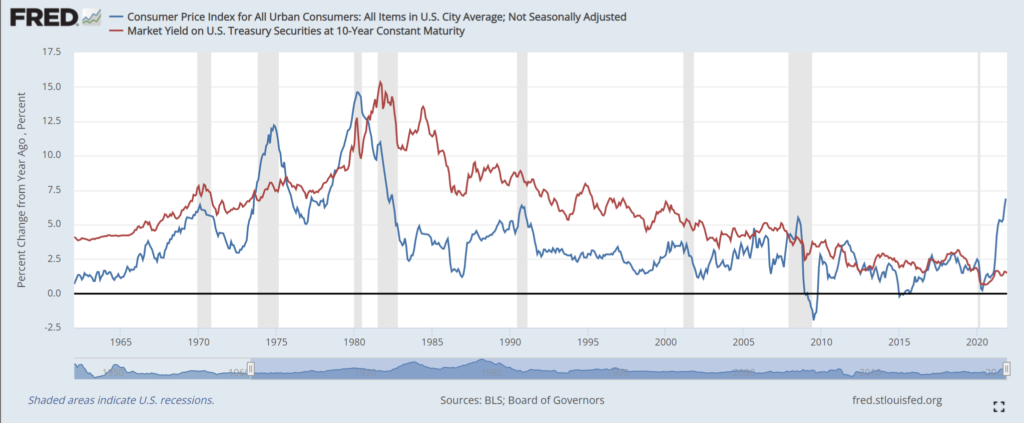

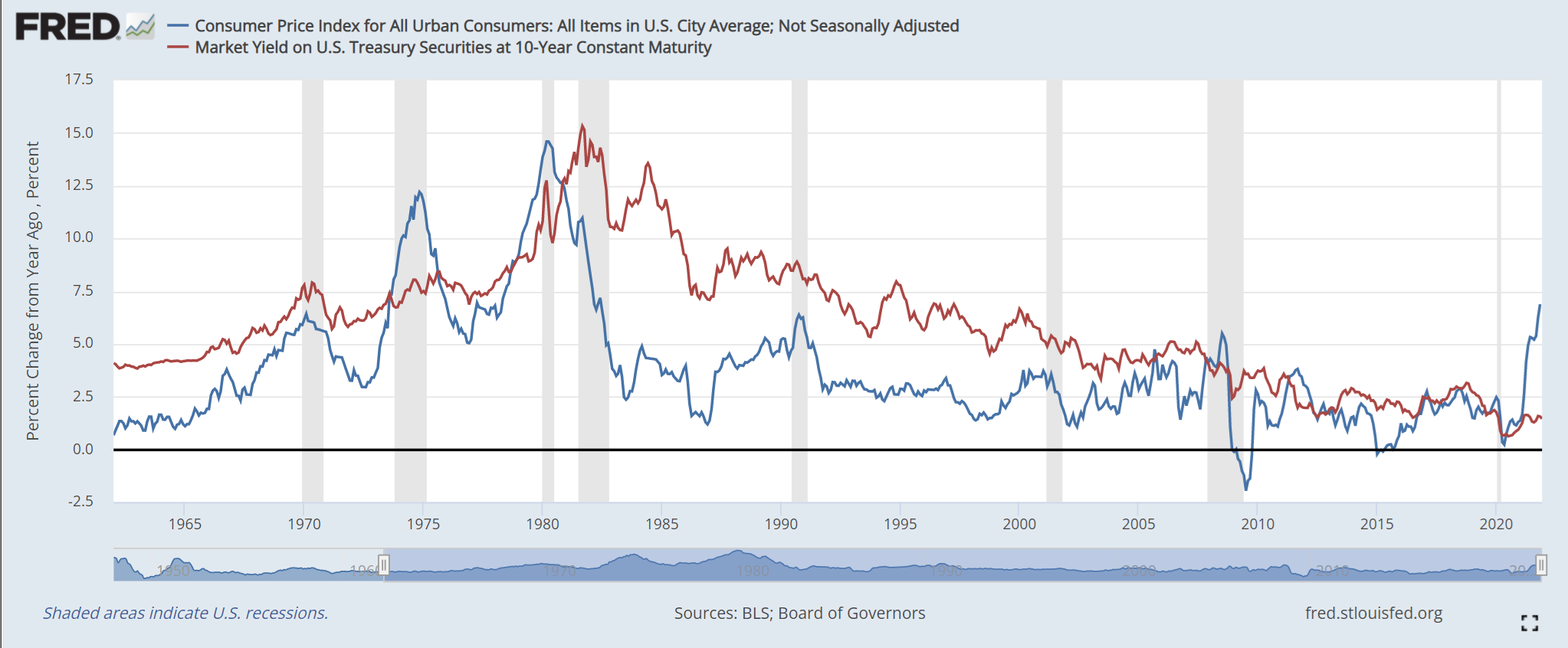

“We are all bracing for interest rates to go up, and we are already seeing traditional lenders raise their real estate interest rates by 75 basis points,” Long explained. “ARM’s interest rate is fixed for the duration of the operating line. The interest rate movement that’s going to happen with traditional banks and with the farm credit system will not affect our customers because the rate is fixed for the year. This is an important point to consider as it’s clear that rates will go up in 2022.”

ARM offers premium hands-on service, and its team is invested in its customer’s business. Traditional lenders renew operating lines, and then you won’t see or hear from them until the following year.

“If something’s happening in your operation, there should be two people you call — the first person should be your crop insurance agent and the second is me,” Long said. “Let me know what’s going on, because there are things that we can do on your operating line to fix or save your operation if it gets to that point. For example, if there’s a hail storm that hits your corn crop, and it’s laying flat in the field in August, that’s a big problem, but we’ll talk and work through it together to find solutions to keep you farming.”

Get started with your nearest ARM team today by calling 855-905-0291 or visiting armlend.com/locations.

One of most frequent questions that Ashley Arrington, Real Estate Division Manager at Ag Resource Management (ARM), gets asked as she’s talking to farmers is “Where are interest rates heading?”

One of most frequent questions that Ashley Arrington, Real Estate Division Manager at Ag Resource Management (ARM), gets asked as she’s talking to farmers is “Where are interest rates heading?”