In the competitive world of agricultural finance, there are alternatives to a traditional bank loan for farmers to consider. But why? What are the differences between a traditional bank loan and getting a loan through Ag Resource Management? Let’s dive into the details.

Comparing Loan Processing and Approval

Most banks are insured by the Federal Deposit Insurance Corporation (FDIC), which means their loans (including agricultural loans) are insured through this independent federal agency. However, being insured by the FDIC also means these banks have more complex processes for making loans and more restrictions on the various types of loans they can make.

For example, an FDIC Financial Institution Letter issued to FDIC-regulated banks in January of 2020 reads (in part), “As headwinds facing the agricultural economy persist, insured institutions must be prepared for agricultural borrowers to face financial challenges by employing appropriate governance, risk management, underwriting and credit administration practices.” You can read the entire letter here: https://www.fdic.gov/news/financial-institution-letters/2020/fil20005a.pdf.

The letter goes on to outline additional recommendations for increased oversight and regulation of agricultural loans.

In other words, the tighter the ag economy becomes, the more FDIC-insured institutions are pressured to increase scrutiny of ag loan applications, ask for more documentation and overall, tighten the criteria for approving agricultural loans.

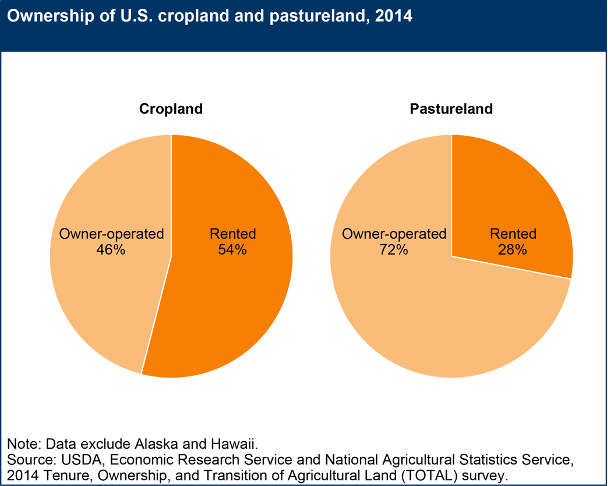

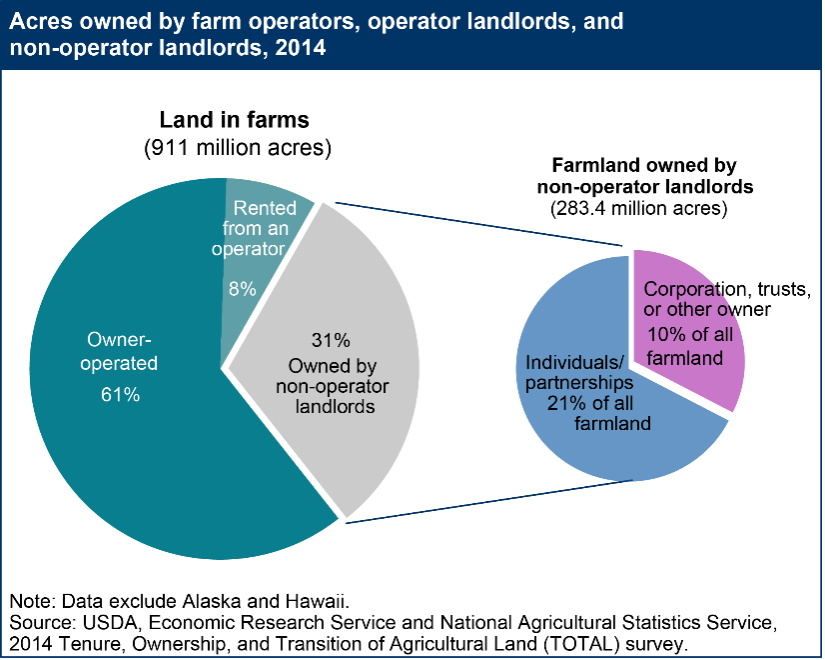

In addition, most agricultural loans approved by banks are based on the farmer’s real estate and equipment equity. Younger farmers, or farmers who rent versus own most of their acres, and thus have lower equity, might find it challenging to get approval for a bank loan.

Traditional bank loans also rely heavily on the historical income of the farming operation. This presents another challenge for a new farmer, who doesn’t have a proven history of producing profitable crops and successful farm management.

“They don’t have equity in real estate, which most young farmers don’t because they don’t own the land they are farming,” explains Don Hastings, an area manager with Ag Resource Management based in Dexter, Missouri. “They’re going to be very limited in their equipment because they’re just starting and making payments on that, so again, low equity. To get a bank loan, many of them would have to go back to their parents or relatives to secure the note that they are a co-signer and co-guarantor of the loan.”

This is where the Ag Resource Management (ARM) loan process differs significantly from those used by traditional lenders. Area Manager Jason Brown, who is based in Waunakee, Wisconsin, explains.

“Our product is tailored to those who don’t have real estate equity, and that lack of real estate equity could be for a variety of reasons,” says Brown. “The business model of farming has changed over the years; and in today’s crop production world, farmers are renting or leasing the majority of their land. That may be because they’re just starting out, or they are expanding their operations and they’re leasing land to grow, and the equity that they do have just isn’t enough for the size of the farm that they need.”

The ARM loan process looks at the value of the crop that’s going into the ground this planting season and government payments crop insurance and then provides loans based upon that future crop value, not on equity.

“We’re more interested in determining the future value of that crop and lending against that whereas the bank is more interested in looking at hard assets,” explains Brown. This means there are significant benefits for farmers who get loans through ARM.

The Benefits of Working with ARM

Two of the key benefits of getting a loan through ARM are freedom and flexibility.

“We turn the farmer back into a cash buyer,” says Brown. “If you don’t get a bank loan, you can consider a loan from a co-op, who’s going to sell you inputs like seed, fertilizer or chemicals. But financing through them means you’re committed into buying inputs from whichever institution will give you credit, and that limits your choices. Your ability to compare prices or purchase the right inputs for what your acres need is reduced. And you’re tied to paying whatever price they are going to sell it to you at. If you have a loan through ARM, you have the freedom to make the right choices for your farming operation and the ability to shop around for the best prices.”

The freedom of an ARM loan also means farmers can pay for things that a co-op isn’t interested in financing.

“We give farmers options,” says Brown. “The co-op isn’t going to finance rents, for example. It may not finance labor and repairs. That leaves the farmers with the additional job of figuring out how to finance those things on their own. We give them a way to finance all of those things.”

Another advantage of working with ARM is that it gives the farmer a knowledgeable financial partner to help them evaluate different financing offers, to construct a financing package that will be most beneficial for their operations. ARM financial experts can help farmers evaluate offers on seed or equipment financing, for example, and make those part of the farmers’ overall financial management plan.

“There are times when working through a supplier, such as your seed company, makes sense,” says Brown. “We’re here to help the farmer determine when that makes sense and when it doesn’t. For example, if the seed company is willing to finance your seed on an unsecured basis at a reasonable rate, let’s use that. That way it frees up some dollars for me to help you in another way. We help farmers create these custom financing packages, and we help them manage that process.”

“That’s a key difference between the way we work at ARM and the way a traditional lender works,” says Hastings. “We’re able to connect with the input suppliers and perhaps get the farmer some additional credit there and work out a partnership deal. We can work with a banking partner and help them get their equipment payments built into our budget. There are so many different ways that we can package deals and offer them solutions. It’s a very well-rounded approach. We look at everything.”

That kind of hands-on partnership with farmers is another key advantage of working with ARM. ARM financial experts monitor the details. And that can save their customers from financial disaster.

“For example, if I have a customer who normally plants 2,500 acres, initially his loan was based on planting that many acres,” says Brown. “But in 2019, for example, it was a horrible, wet spring. Lots of prevent plant acres, and he only ended up getting 1,600 acres planted, which was the case for many farmers. In late summer, we went over those numbers, and I told him we needed to reduce the loan, so it was based on this lower acreage. He may not have been happy about that at the time. But fast forward to December when we are recapping the year, and he had just enough crop expenses to get his loan paid back. We did the right thing, even though it wasn’t an easy thing to do, and it saved them from being short on their loan.”

Lastly, and this is a big one, there’s the advantage of speed.

It can take weeks or even months to get the final word on a loan from a traditional lender. But because ARM doesn’t need to wait on a real estate or equipment appraisals or other procedures that draw out the loan process, they get farmers the loan money they need much more quickly. In most cases, ARM loans are processed and in the farmer’s bank account in less than a week. And in the dynamic world of crop production, having the money when you need it is crucial.

“Other lenders make decisions by looking at tax returns based on the previous calendar year, among other things,” explains Brown. “The tax year ends December 31, so they might get those tax returns in mid-February or even early March. They need time to digest those financials, so the physical calendar keeps inching closer and closer to planting season, and the farmer doesn’t have the capital to make buying decisions until April or May if they’re working with a traditional lender. On the flip side, I can help them in December and January and get them their money quickly. We give them the capital they need in a timely fashion, so they can be more successful.”

To learn more about the advantages of working with ARM, visit www.armlend.com.